- Francisco Money

- Posts

- AI ́s role in shaping the workforce: Chamath Palihapatiya perspective

AI ́s role in shaping the workforce: Chamath Palihapatiya perspective

Exploring a YC backed company

Greetings!

Welcome to The Menu Magic - Finance & AI newsletter

In today’s email:

AI´s role in shaping the workforce: Chamath Palihapatiya perspectiveAI´s role in shaping the workforce: Chamath Palihapatiya perspective

Exploring a YC backed company

Meme of the week

AI´s role in shaping the workforce: Chamath Palihapatiya perspective

Hey there, my dear friend! 🌟

A tweet by Chamath Palihapitiya, a prominent venture capitalist and tech influencer, has ignited discussions about the implications of Artificial Intelligence (AI) on workforce dynamics and company operations.

The Context: Streamlining at Twitter/X

Chamath's tweet brings attention to a significant workforce reduction at Twitter/X, where an astounding 80% of the company was laid off. Despite initial skepticism, the company not only sustained its operations but also experienced record usage after the downsizing. This outcome prompts an intriguing question: Could a streamlined workforce, augmented by AI tools, be the blueprint for efficient business operations in the future?

The Implication: A Decision Point for Public Companies

Chamath outlines two potential trajectories for public companies in this era of AI:

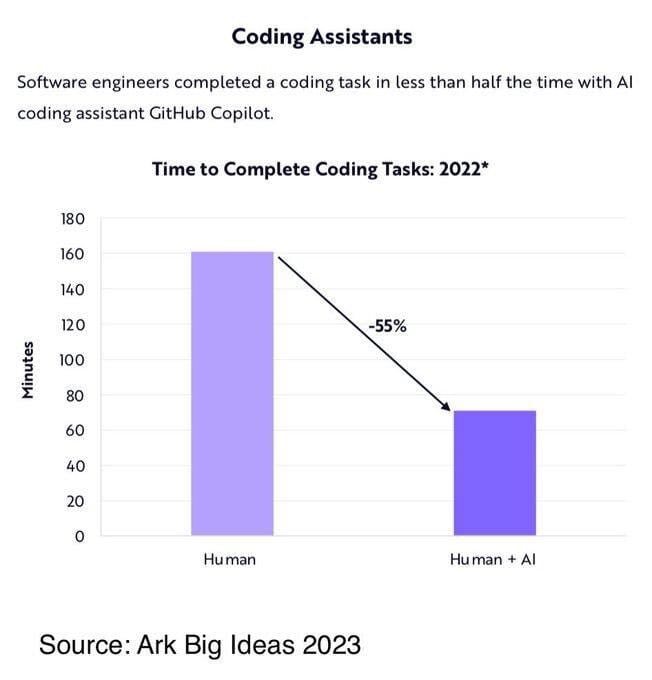

1. Boosting Productivity: Companies could aim to amplify their work output, delivering more code and enhancing product value, all while retaining their current workforce size. This suggests that with the right tools, the existing team can achieve significantly more.

2. Prioritizing Efficiency: On the other hand, companies might consider cutting their R&D and operational expenses by half. This would involve a combination of a smaller team and AI tools to achieve what the entire team did in the past.

The Reality Check: Revenue as a Measure of Productivity

Chamath underscores the importance of correlating productivity claims with revenue. If a company states that it has doubled its productivity by equipping its employees with advanced tools, this uptick should be evident in its revenue. Absent this, such assertions might lack substance.

Given this viewpoint, the second trajectory – trimming operational costs and harnessing AI tools with a leaner team – appears more feasible. This approach not only aligns with tangible success metrics like revenue but also provides added value to shareholders by conserving on stock-based compensation (SBC) dilution.

The Bigger Picture: Meeting Shareholder Expectations with AI

Shareholder expectations significantly influence company decisions. As AI tools become increasingly sophisticated and widespread, shareholders might lean towards advocating for more efficient, leaner operations. If superior results can be achieved with fewer resources, it's a financially sound strategy to adopt.

In Conclusion

Chamath's insights offer a window into the potential trajectory of business operations in the AI era. While discussions about the ethical and societal ramifications of workforce reductions in favor of AI tools are ongoing, it's evident that companies must adapt to remain competitive. Whether through heightened productivity or streamlined operations, AI's integration into the workforce is becoming increasingly essential. As we traverse this shift, striking a balance between efficiency, innovation, and human-centric approaches will be crucial.

Exploring a YC-backed company

Hey there,

I've been diving into Quill AI lately, and I thought you'd appreciate a quick rundown. At its core, Quill AI offers an AI-powered copilot for investors. It's not just about crunching numbers; it's about understanding market nuances and offering insights tailored to individual investment strategies.

Features that Stand Out:

Personalized Insights: Quill AI seems to adapt to the user's investment style, offering tailored advice and predictions.

Real-time Market Analysis: With its AI capabilities, it can analyze market trends in real-time, potentially giving investors an edge.

User-friendly Interface: Even with its advanced tech, I've heard it's designed to be intuitive for both novice and experienced investors.

Challenges Ahead:

Trust in AI: Convincing traditional investors to trust AI over human intuition is a hurdle.

Data Security: With financial data involved, they'll need top-notch security measures to ensure user trust.

Market Competition: The fintech space is crowded, and standing out requires constant innovation.

I'm intrigued by the potential of Quill AI, especially with the backing of YC. But like all startups, they have their work cut out for them. It'll be interesting to see how they navigate these challenges and if they can truly revolutionize the investment landscape.

Catch up soon, and let me know if you explore Quill AI further!

Meme of the week

Be loyal

I'd love to hear your feedback on today's newsletter! Is there a specific type of content you'd like to see more of in the future? Since I'll be releasing a new edition each week, I welcome any suggestions or requests you may have. Looking forward to hearing your thoughts!

The Menu Magic is written by Francisco Cordoba Otalora, a Fintech entrepreneur living in London.

Share this newsletter with a friend