- Francisco Money

- Posts

- Elon Musk's Game of 'X'

Elon Musk's Game of 'X'

Turning Twitter into the West's Ultimate Super App

Greetings!

Welcome to The Menu Magic - Finance & AI newsletter

In today’s email:

Elon Musk's Game of 'X': Turning Twitter into the West's Ultimate Super App

A pinch of Spice: The East India Company´s legacy in modern finance in London

Venture Builder to eliminate environmental threats to our health

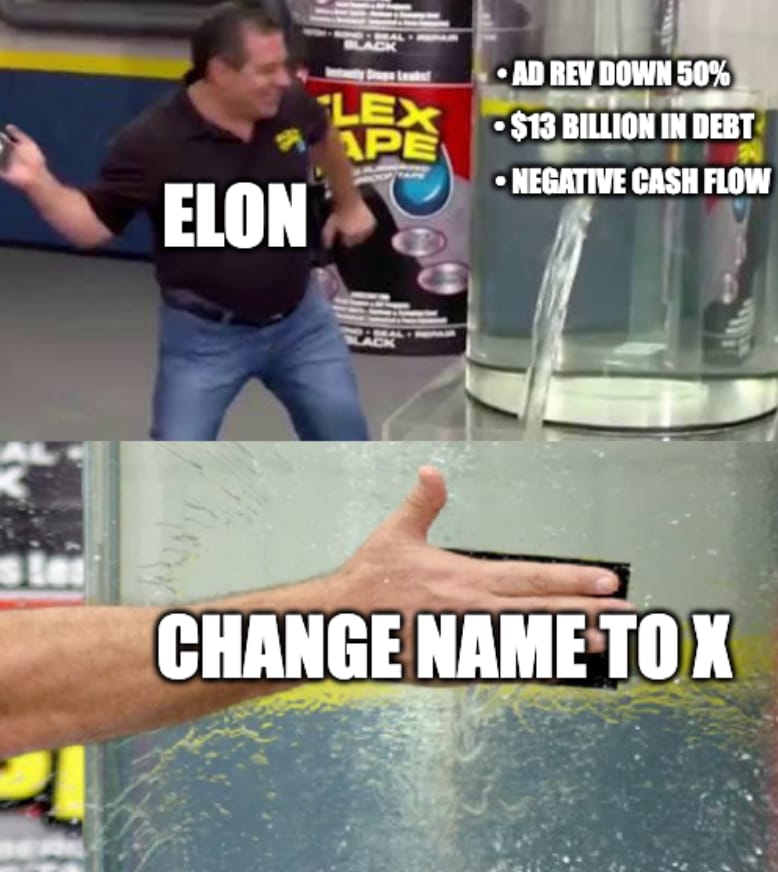

Meme of the week

Hello there, folks!

Elon Musk's Game of 'X': Turning Twitter into the West's Ultimate Super App

Elon Musk has unveiled a surprising decision to change Twitter to "X". This bold move forms a key part of his ambitious 10-year strategy, promising a dramatic transformation of the popular social media platform.

Renaming Twitter to just "X" is only the tip of the iceberg. Musk has set his sights far higher. He plans to leverage Twitter's reach and influence to morph it into the West's foremost super app, mirroring the ubiquity and functionality of WeChat and Alipay in China.

While other tech giants like Whatsapp have dabbled in similar aspirations, their efforts have been notably cautious. They've shied away from implementing robust payment systems, limiting their reach to select markets like Brazil, and even nixed their own cryptocurrency ventures. But that's not Musk's style - the man doesn't do half-measures.

In Musk's grand vision, Twitter's over 400 million users won't just come to tweet, they'll come to transact. And he's not just talking about digital payments. He's thinking bigger, much bigger.

Picture this - Twitter becoming a hub for financial services, competing with the likes of YouTube by rewarding its active user base. Imagine businesses using Twitter to deliver their services more rapidly and effectively, bolstered by an integrated payments system. And to top it all, he foresees a future where instant global payments are the norm, not the exception.

What's more, Musk's strategy doesn't stop at Twitter's current capabilities. He's aiming to leverage the platform's established communities to drive his new vision. With a vibrant financial community already in place, Twitter could easily transition into a marketplace for investment products like stocks and ETFs. We could see Twitter partnering with financial giants, enabling users to not just tweet about their favorite stocks, but buy them right there and then.

Having long been a high-profile advocate of cryptocurrencies, Musk is well-positioned to bring his own crypto payment system to the platform. This wouldn't be the first attempt by a tech giant to implement a cryptocurrency - remember Facebook's ill-fated Libra project? Yet, Musk is no stranger to learning from others' failures. He could utilize the lessons from Facebook's missteps to navigate the complex regulatory landscape and avoid the pitfalls that doomed Libra. The incorporation of a robust, user-friendly crypto payment system within "X" could not only boost user engagement but also potentially revolutionize the way users interact with digital currencies.

While Musk's audacious plan for transforming "X" into a super app holds great promise, there are potential stumbling blocks along the way. The tech industry is replete with examples of ambitious projects that failed to take off due to a variety of reasons, ranging from regulatory hurdles to poor execution.

One of these tales involves Musk himself, dating back to the early days of PayPal. In the year 2000, Musk, then CEO of the burgeoning online payments service, rolled out a loan service. It was an ambitious move, aimed at broadening PayPal's suite of services. However, the venture quickly foundered due to high non-repayment rates, leading to significant financial losses for the company. This misstep, coupled with disagreements within the team about the company's strategic direction, ultimately resulted in Musk being ousted from his position as CEO.

Musk's past experience with PayPal provides a cautionary tale for his current venture with "X". Implementing wide-ranging services like financial products and instant global payments could be a risky move, potentially opening the door to high default rates and regulatory scrutiny. While Musk's record of turning ambitious ideas into reality is impressive, the transformation of "X" into a super app will likely be fraught with challenges and may not go exactly as planned.

Musk isn't just playing chess here, he's playing 4D chess. And while it's a bold gambit that will inevitably draw criticism (not least for replacing the iconic Twitter name), Musk's track record suggests that he could very well pull it off. With the resources, technology, and global reach at his disposal, his $44 billion investment could potentially increase tenfold in the next decade.

So, let's call it "X for Everything." As we head into an era of unprecedented financial transformation, Twitter - or should I say, "X" - could very well be the unlikely hero leading the charge. As for me, I'm not going anywhere. Despite Meta's promise of new frontiers (with threads net), I'm staying where the action is. Twitter, "X", call it what you want, it's the place I learn the most.

So, folks, buckle up. We're in for quite a ride. If you want to read Walter Isaacson's book on Musk, find the excerpt of the book here.

In 1999 his concept for http://X.com was grand. It would be a one-stop everything-store for all financial needs

A pinch of Spice: The East Inia company´s legacy in modern finance

I've got a cracking story for you today. A few days ago, I found myself wandering through the Museum of London Docklands, basking in the faded glory of a time gone by.

This place, a testament to our city's storied past, is located in Canary Wharf, a district that is now synonymous with steel and glass skyscrapers. It's sort of like strolling through a time warp, where the old and the new exist side by side, competing for attention.

Now, let me spin you a yarn from the olden times that caught my attention. Back in the 17th century, the Dutch had a pretty firm grip on the spice trade from the East Indies. They were selling these exotic spices to Europeans at a pretty penny, and let's just say, they weren't too keen on competition. The Dutch, being savvy business folks, decided to up the spice prices even further.

This move didn't sit too well with the entrepreneurial lot back home in England. They thought, "Why should the Dutch have all the fun (and the profit)?". And so, they rallied together, got their hands on £72,000 (an astronomical sum at that time), and launched a venture to wrestle control of the spice trade from the Dutch. This audacious move led to the formation of the East India Company, which would eventually grow into a commercial juggernaut, influencing global trade for centuries.

Now, here's the interesting bit. The very docks where the East India Company once loaded and unloaded its precious cargo of spices, tea, and other exotic goods is where Canary Wharf now stands. That's right - the same place that was once the epicentre of world commerce has been reinvented into a district of gleaming towers and bustling businesses, a symbol of the modern globalised world.

But what's particularly intriguing is how the surviving infrastructure from the East India Company era has been seamlessly woven into the fabric of Canary Wharf. Old warehouses have been transformed into trendy eateries, the erstwhile dock has been converted into a marina, and heritage buildings stand proudly amidst the towering skyscrapers.

In essence, Canary Wharf is a striking example of our past informing our present, and arguably, shaping our future. It's a reminder of how the pursuit of a simple ingredient like spice can ripple through time, influencing centuries of trade, shaping economies, and even giving birth to global corporations.

Isn't it fascinating how a pinch of history can flavour our understanding of modern finance? Until next time, stay curious!

Venture Builder to eliminate environmental threats to our health

We'll be looking to invest in 70 individuals who want to build a new startup from scratch that tackles the harmful impacts of chemical pollution, climate change, and biological hazards on our health and well-being. They will focus on areas like food systems, water security, air quality, and built/urban environments (more in our manifesto here).

The venture-builder starts in October 2023 and is a full-time commitment where individuals will meet with one or more co-founder(s), receive up to £250k in early funding, and gain access to mentorship & support from experts, coaches, investors, and Zinc’s in-house team.

If you know someone who would be a good fit, please do encourage them to apply.

Meme of the week

Meme of the week

I'd love to hear your feedback on today's newsletter! Is there a specific type of content you'd like to see more of in the future? Since I'll be releasing a new edition each week, I welcome any suggestions or requests you may have. Looking forward to hearing your thoughts!

The Menu Magic is written by Francisco Cordoba Otalora, a Fintech entrepreneur living in London.

Share this newsletter with a friend